9 HOPD-to-ASC Conversion Upsides for Health Systems

Is your health system thinking of converting a hospital outpatient department (HOPD) into an ambulatory surgery center (ASC)?

Here are nine reasons why this ASC development strategy can help your health system fortify a competitive edge in your market.

1. ASC market growth is outpacing growth in other healthcare sectors.

By 2028, the US ASC market will be $33 billion, up from $30 billion in 2019. That’s a 6.9 percent compound annual growth rate (CAGR). (Experts forecast that healthcare generally has a less-than 5 percent CAGR over the next few years.)

Revenue from single-specialty ASCs will grow from $13.4 billion in 2021 to $21.8 billion in 2028, one market research firm forecasts.

2. When the procedure is performed in an ASC, the cost to payers and patients is less.

Between 2019 and 2028, Medicare will save $73.4 billion on procedures that are performed in ASCs rather than HOPDs, ASCA and KNG Health Consulting estimate.

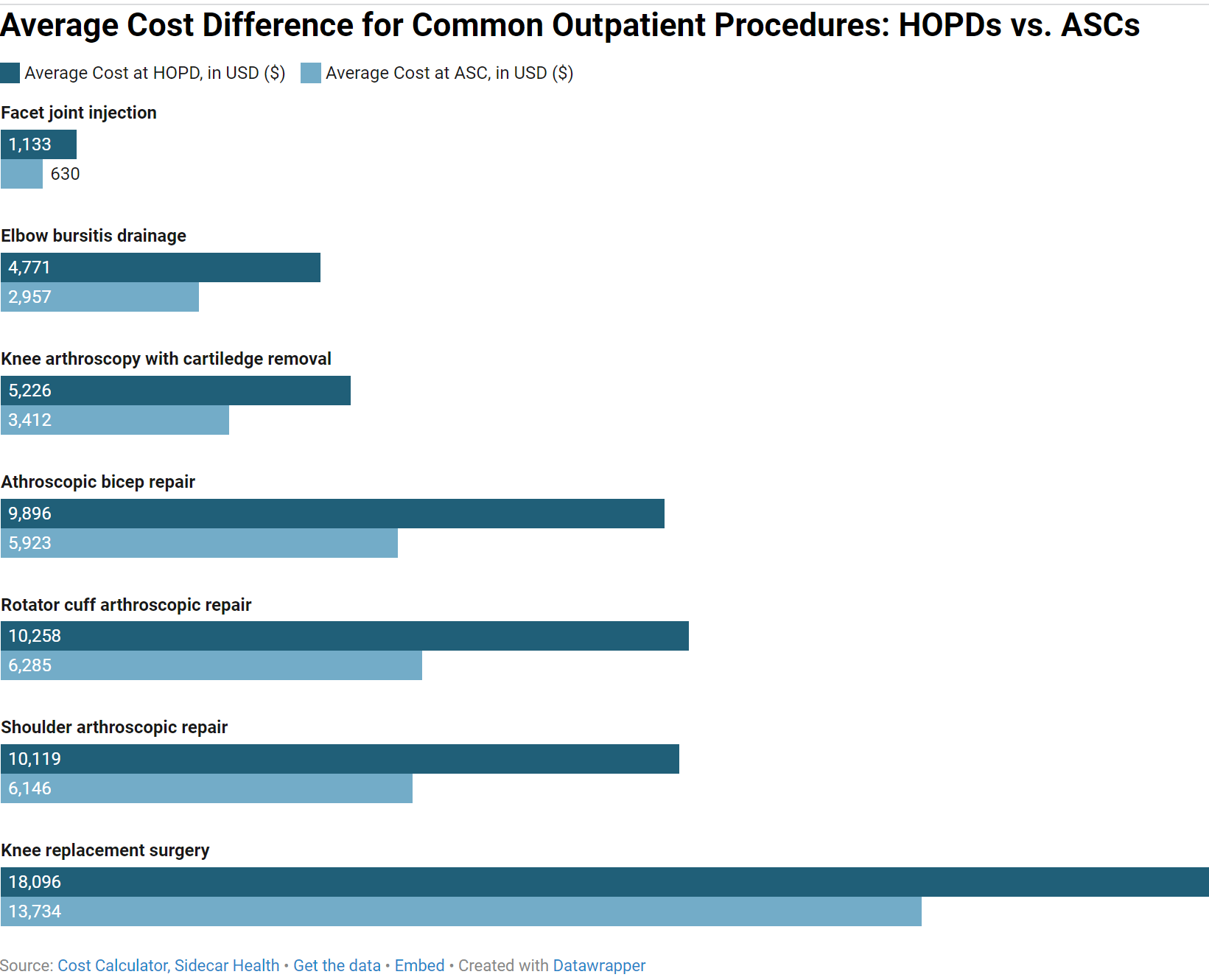

For example, the average cost for a knee arthroscopy with cartilage removal in an ASC is $3,412, according to Sidecar Health’s Care Calculator. In contrast, the same procedure costs $5,226 when performed in an outpatient hospital.

What’s driving the cost difference? The facility fee paid to an HOPD is typically much higher than the facility fee paid to an ASC for the same procedure. For the knee arthroscopy above, the outpatient hospital fee is $3,422. In contrast, the surgery center fee for the same procedure is $1,608.

A similar pattern holds for other commonly-performed musculoskeletal procedures:

3. Price transparency requirements are helping patients understand the lower costs of ASCs.

Functional price transparency isn’t a reality yet. But it’s coming.

Since January 2021, CMS has required hospitals to post standard and negotiated rates for 300 “shoppable services,” 70 of which CMS mandates. On the mandated list are orthopedic procedures commonly performed in ASCs, such as spinal fusion and joint replacements.

At present, hospital pricing is still quite opaque. Only one-quarter of hospitals have been able to comply fully with the rule so far. The data is unreliable and much too clunky for consumers to use at present.

But consumers will become more accustomed to shopping around for healthcare as data becomes more reliable and easier to use. Health systems that can offer lower-cost ASC settings will benefit.

4. HOPDs are losing their reimbursement edge.

In the past, HOPDs received much higher reimbursements than ASCs did, mostly because they commanded much higher facility fees. In those days, there wasn’t much financial incentive for hospitals to own and operate ASCs.

But the reimbursement advantage that HOPDs used to have over ASCs is going away as federal and private payers adjust what they call the “site-of-service differential.” Another common term to describe this effort is “site-neutral payment reform.” Such reform could save Medicare as much as $153 billion over the next decade. It could save Medicare beneficiaries $94 billion in premiums as well, one think tank estimates.

In the past, CMS used two different methodologies to calculate Medicare reimbursement for facilities: regulators used the Consumer Price Index for ASCs and the hospital market basket index for HOPDs. Differences in how CMS calculated reimbursement meant that the facility fees for HOPDs were much higher than they were for ASCs.

Since 2019, CMS has used the hospital market basket index to calculate reimbursement increases for both ASCs and HOPDs. The ASC facility fee is still significantly less than the HOPD facility fee, but the gap is closing and will continue to narrow.

Health systems looking to plan ahead for this new reimbursement reality are looking to perform HOPD procedures in health system-owned ASCs instead.

5. High-acuity case migration is driving more procedures to ASCs.

Technical and anesthetic advances are making more procedures safe and effective in outpatient settings for most patients.

In recent years, procedures like total knee replacement and total hip replacement, which used to be on inpatient-only lists, can now be performed in outpatient settings.

As a result, health system leaders expect inpatient volumes to drop and outpatient volumes to rise. By 2028, 85 percent of procedures will be performed in outpatient settings, Sg2 predicts.

Nader Samii, CEO of nimble solutions, estimates that, by 2025, ASCs will perform:

- 68 percent of orthopedic procedures (a 31% increase from 2018);

- 30 percent of spine procedures (a 200% increase from 2018); and

- 33 percent of cardiology procedures (a 230% increase from 2018).

6. ASCs boost surgeon recruitment and retention.

The physician shortage is getting worse, and it’s not just primary care that’s feeling the squeeze these days. By 2034, surgical specialties will be short 15,800 to 30,200 physicians, AMA estimates.

Health systems that want to prevail in the talent wars will need to offer ASC options to their employed, affiliated, and aligned independent physicians. About 60% of physicians who aren’t currently affiliated with an ASC are interested in practicing at one, according to a recent Bain survey.

Many surgeons prefer ASCs over HOPDs. On average, procedures take 31 minutes less to perform in ASCs than they do in hospitals, which boosts surgeons’ earning potential.

ASCs are especially attractive to physician entrepreneurs who want to exercise autonomy in an increasingly complex healthcare system.

7. ASCs help health systems hold onto–and grow–their market share.

Surgeons who are aligned with an ASC are less likely to leave a health system than employed physicians are. When surgeons and health systems are working together in an ASC, the relationship is much stickier.

For this reason, the ASC is a tool that discourages employed physicians from leaving your health system to align with competitive systems or practices.

8. Commercial payers are pushing ASC settings.

Their tool? Prior authorizations, which often specify that certain types of procedures be performed in ASCs.

Prior authorization requirements aren’t a full-on gamechanger yet. But in the future, procedures performed in ASCs will be easier to get approved than procedures performed in HOPDs.

9. ASCs are a win-win for health systems aligned with health plans.

Is your health system one of the 51 health systems that currently own a health plan–or operate a health plan in a joint venture with an insurer? If so, transitioning procedures from HOPD to ASC settings is particularly strategic for you.

Because ASC settings lower the cost of care, they can increase profit margins for your health plan.

So what’s the next step for my health system’s HOPD-to-ASC conversion journey?

Converting an HOPD into an ASC can bring huge upsides to your health system, but the strategy is not a silver bullet. Launching and operating an ASC requires much different strategies and tactics than those your health system has deployed for HOPDs.

In our next post, Sean Rambo will outline key points your health system should consider before you convert an HOPD into an ASC.

Want to explore whether an HOPD-to-ASC conversion is feasible for your health system? Contact the ASC development professionals at Compass Surgical Partners to learn more.

Recent News

-

Bon Secours Mercy Health and Compass Surgical Partners Announce Grand Opening of World-Class Surgery Center in Greenville, South Carolina

-

Healthcare Trailblazers: The Compass Surgical Partners Journey

-

Proactive Payer Credentialing Preps Your New ASC for Financial Success

-

Advanced Joint and Spine Institute Orlando and Compass Surgical Partners Open World-Class Orthopedic Surgery Center

-

How Your Health System Can Win the CV ASC Market

Copyright © 2024 Compass Surgical Partners

Site Design by Swarm Interactive | Admin Login